By Michael Wolf

The housewares industry is changing, but I wouldn’t blame you for missing it. That’s because industry evolutions happen subtly and slowly and, as a result, it’s often easy to miss the big shifts. Most of us, after all, are busy doing our job.

But the old adage “the days are long but the years are short” applies just as much to market evolutions as well as it does to life. If you don’t pay attention to the longer arc of change in your industry, chances are you’ll miss how e-commerce, cloud computing, Internet of Things, artificial intelligence and data are changing the way business is being done.

How can you prepare for the future? Below are five of the most transformative changes underway in the housewares industry and a couple suggestions on how to future-proof your business and not get left behind.

Connected Commerce

Through the arrival of embedded smart technology, virtual assistants and connections to online commerce systems, we are seeing the point of sale going from the cash register to the point of consumption in the home. Consumers are not only transitioning to subscription models and auto-ordering of consumables, but increasingly relying on virtual assistants like Alexa to help them go shopping. Longer term, many will allow appliances to order products through algorithmic purchasing based on preferences, current needs and past behavior.

How does a housewares brand prepare for an era of more connected commerce? If your product uses a consumable, start by finding ways to plug your product into API-powered commerce systems enabled by Amazon, Google and Walmart to give your customers more options. Understand how consumers are embracing new interaction paradigms like voice control. Most importantly, work with your consumer packaged good partners to create low-friction ways for consumers to buy their products.

Connected Content

It used to be that physical product companies didn’t need to worry about creating content. As most know, that’s changed over the past decade as the Internet has forced companies once focused primarily on hardware to develop content strategies for marketing, community development and thought leadership.

Now, even that may not be enough. That’s because as today’s kitchen becomes increasingly connected, a resulting combination of new content formats and next-gen interfaces is starting to change consumer behavior. Consumers are using digital discovery formats to learn, shop, cook and manage their lives, and as a result, content is being created specifically for consumption through apps, voice interfaces and on new screens such as the Amazon Echo Show. New market entrants like Tasty are becoming competitors with traditional housewares makers, while big appliance companies like Whirlpool/KitchenAid are investing in companies like Yummly.

New Business Models

New Business Models

Perhaps the biggest change in the connected housewares industry is the emergence of new business models. Whether that’s the ability for appliance makers to enter adjacent categories like food delivery, access consumer usage data or perform remote diagnostics and upgrades of appliances in the field, more and more modern housewares companies are embracing these changes and considering new business models previously thought impossible.

The good news for retail and channel partners is these new approaches open up exciting opportunities for those selling housewares products to the consumer. By becoming the onboarding part for product companies for new subscription services, sharing economy models and more, channel players can also possibly increase their total margins by taking part in ongoing monthly recurring revenues.

Invest in Software (Or Find a Partner Who Can)

The founder of Netscape, Marc Andreessen, once famously wrote, “software is eating the world.” His point, made through an op-ed in The New York Times, is that every company will eventually become a software company as computing becomes more pervasive, devices get more connected, computers sit in everyone’s pockets and businesses become required to use software to optimize and compete.

His point, made in 2011, is as true today as ever and, have no doubt, applies to the housewares industry. Products from ovens to refrigerators to washing machines are now being upgraded in the field, adding new features that weren’t available when the consumer left the store. But it’s not just connected devices. Recipes are going from a set of instructions on a dead piece of paper to dynamic meal guides with built-in shopping capabilities. Food companies such as Campbell’s are developing software apps for voice assistants and connected devices to build communities and retain customers. Cookware companies like Hestan are building software platforms to enable their devices to talk to build appliances.

While most housewares companies do not typically have in-house software expertise, it’s not too late. Today there are a variety of solution providers providing technical expertise and turnkey platforms. While companies will need to pay close attention that their efforts promise to bring significant value to their customers, it’s important to start building software strategy with partners and eventually internally.

Embrace the Data

Perhaps the biggest change emerging from a smarter, more connected kitchen and food industry is the arrival of real-time consumer data.

In the past, housewares and packaged good providers really had no visibility into how consumers used their products once they left the store shelf. Nielsen data provided a rough outline, but like the TV rating system of yesteryear, these types of methodologies are woefully outdated and don’t alert us in real time to trends, product issues and consumer sentiment.

That is all changing quickly. From smart countertop electrics to fridges with inventory management systems to connected homes that understand how we live, we will see a flood of highly contextual and up-to-the-minute data that can be harnessed to bring more value to consumers through these products.

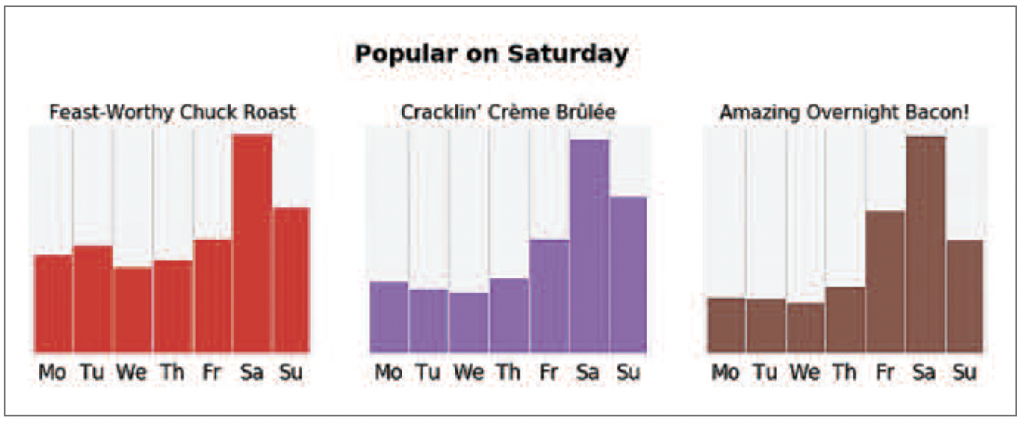

One early example of a company utilizing data derived from in-home consumer behavior is ChefSteps. The company is able to aggregate and monitor consumer usage data for its Joule sous vide appliance. The chart below shows how the company is able to understand the most commonly cooked meal on, say, Saturday, and monitor how its own advertising and outreach campaigns can impact consumer behavior.

The good news is many housewares brands have in-house data analytics capabilities. However, most predictive analytics center on traditional channel data burnished with survey trend data, but these supposed forward-looking data sets are more of a window into the near distant past rather than a window into how consumers are using products today. By embracing platforms that expand their view into real-time consumer usage, housewares and consumer packaged good companies can understand how consumers are truly using their products today.

In summary, while today’s housewares executives are aware that large scale shifts are coming their way, many have yet to transform their businesses. By beginning to think through strategies outlined here and starting the process of outlining your strategy, you can help ensure that your company will be ready for what will be a drastically different marketplace in five to 10 years.

Michael Wolf is founder of the Smart Kitchen Summit, the leading event focused on the future of food, cooking and the kitchen. He can be reached at mike@thespoon.tech.