By Thomas A. Cook, Managing Director, Blue Tiger International

The United States exported $2.53 trillion in goods and services in 2021, an increase of 18.5% over 2020. Of that, $1.76 trillion were goods, according to the US Census Bureau of Economic Analysis. Expanded opportunity awaits the US housewares industry. This four-part blog series, provided by Blue Tiger International will help IHA members recognize steps to identify and capitalize growth through exports.

Developing a Post-Pandemic Export Strategy: The Great Export USA Reset

Part 1 of a 4-Part Series

The pandemic disrupted global supply chains and shattered supply-demand norms, spurring a new appetite for US exports.

USA-based companies in many verticals, and especially those in housewares and related products, have a unique opportunity to sell abroad in general and more specifically “post-Covid” where a window of opportunity has opened.

The opportunity has developed as many typical developing nations and even some stalwart supplier nations have had difficulty in manufacturing, distribution, and supply chain management.

The demand for consumer items has shown unprecedented growth all over the world, including Europe, Middle East, larger African nations, and certain countries in Asia.

The typical supplier markets of the world have fallen short in delivering timely, competitively priced and high-quality products, as they had pre-Covid.

That void has been filled by a few American manufacturers and distributors, but the opportunities can easily be expanded to a much larger group of USA-based companies.

The opportunities are out there … but one needs to know where they are, how best to access and how best to export.

The balance of this article and the additional three parts to this series will explore the challenges and even more importantly … create the blueprint for successful export sales business development.

This first article will outline all the major issues for an IHA member to consider when building a successful export program. These concepts will apply to a company new to export or even a more seasoned exporter.

Exports can create significant opportunity for companies seeking expansion of their overseas markets. Keep in mind that 95% of the consumer market lies external to the United States.

That said, exports can create certain risks. It is critical to understanding these risks and managing these exposures so that success can be gained. Tied into the successful exporter are creating “Best Practices” which reduce risk and create the best path forward.

Best Practices Summary:

Make Sure You Are Committed to Exporting

Exporting requires funding, resource development and time. Make sure you have budgeted correctly for export business development and are aligned with external resources to provide support.

Depending upon your internal expertise, utilizing third party consultants who excel in this area, would be a prudent decision.

Blue Tiger International has a very specific program structured for members of IHA.

Assess Your Products’ Export Readiness

You need to determine how ready your product is for the export market. This could include formulizations, packing, marking, labeling, ingredient structure, etc.

Keep in mind, that different countries have different rules, that are critical to know, acknowledge and comply with.

Export Data is Essential

Collecting data on exports provides an initial overview of potential markets and insight on where you should focus. Partnering with consultants accessing information, data and statistics on exports is very important. In the USA, the Department of Commerce can be an invaluable resource.

Short-term Focus

Identify 2-4 initial markets to reach out to. “Experiment”. Test the opportunities and determine the viability of your export opportunities. Begin the learning curve and adapt.

Selling Directly or Through Distributors/Agents

Part of your assessment will be to determine whether to sell direct to end-users or go through importers/agents/distributors.

Generally, we recommend selling through third parties, especially in the beginning.

Advantages:

- Immediate local expertise

- Immediate access to potential clients and sales

- Assumes some of the “risks”

- Can provide assistance in the supply chain: logistics, warehousing and distribution

Disadvantages:

- Intellectual Property Rights

- Loose control over local markets

- Another entity that may require serious management oversight

Your Exports Become Imports

Recognize that your export will become an import for your customer overseas thus requiring an understanding of the basic import regulations of the countries you sell to. Maintain compliance with all of the buyer’s country import regulations. Documentation, packing, marking, labeling, formularizations are but some of the concerns.

Utilize the correct INCO terms

Learning the basics of INCO Terms is important, then applying that knowledge to ensure that you are utilizing the term best suited to meet the needs of your specific export transaction.

The seven Incoterms® 2020 rules for any mode(s) of transport are:

EXW Ex Works (insert place of delivery)

FCA Free Carrier (Insert named place of delivery)

CPT Carriage Paid to (insert place of destination)

CIP Carriage and Insurance Paid To (insert place of destination)

DAP Delivered at Place (insert named place of destination)

DPU Delivered at Place Unloaded (insert of place of destination)

DDP Delivered Duty Paid (Insert place of destination).

Note: the DPU Incoterm replaces the old DAT, with additional requirements for the seller to unload the goods from the arriving means of transport.

The four Incoterms® 2020 rules for Sea and Inland Waterway Transport are:

FAS Free Alongside Ship (insert name of port of loading)

FOB Free on Board (insert named port of loading)

CFR Cost and Freight (insert named port of destination)

CIF Cost Insurance and Freight (insert named proof of destination)

As a point of reference, if your intent is to sell where the customer picks the goods up at your place of origin, utilize FCA and not FOB or Ex Works, as you are likely to load the arriving conveyance.

Also keep in mind that trade compliance – rather than convenience – is often a more important driver of the choice of INCO Term.

Make Sure You Understand the 7 Basic Requirements to Reduce Risk in Export Transactions

- Terms of Sale (INCO Term)

- Terms of Payment

- Insurance Requirements

- Freight Handling

- Compliance Responsibilities

- Accounting for the Transaction (GAAP/IRS)

- When “ownership” transfers

Utilize the Correct Schedule B Number (HTSUS)

It is important to make sure you choose the correct Schedule B number, also referred to “HTS Number”. Your freight forwarder or consultant can guide you in this determination.

Understand the “Documentational Requirements”

You are creating an export, which requires conformance with U.S. based export regulations. Simultaneously, you are facilitating an import overseas and thus must also comply with the import regulation of the country you are selling to.

Your freight forwarder or consultant can guide you in these documentary requirements.

Basic Export Documentation Requirements

- Ocean/Air Waybill

- Domestic Bill of Lading/Drayage

- Certificate of Conformity

- Certificate of Origin

- Commercial Invoice

- Dock/Warehouse Receipt

- Export License

Develop an Export Trade Compliance Mind-Set

- Export Packing List

- Inspection/QC Documents

- Insurance Confirmations

You need to make sure you are complying with all export regulatory requirements. Areas that need to be addressed include, but are not limited to, are as follows:

- Denied Parties Checking

- Destination Control Statements

- Ultimate Consignees

- Product Utilizations

- Destination Country Allowance

- Export License Requirements

Contracts of Sale/Agent/DistributorUtilize a professional consultant or attorney to guide you into these documents of agreement that will bind you to certain obligations.

- The parties

- The description of the products

- Quality

- Price per unit

- Total value

- Currency

- Tax and Charges

- Packing

- Marking and Labelling

- Mode of Transport

- Delivery: Place and Schedule (INCO Term)

- Insurance

- Inspection

- Documentation

- Mode of Payment

- Credit period, if any

- Warranties

- Passing of Risk

- Passing of property

- Export-Import Licenses

- Force Majeure

- Settlement of Disputes

- Proper Law of the Contract

- Jurisdiction

Protect Your IPR

Intellectual property (IP) refers to creations of the mind: inventions; literary and artistic works; and symbols, images, names, and logos used in commerce. Businesses are often unaware that their business assets include IP rights.

Your intellectual property is a valuable intangible asset that should be protected to enhance your competitive advantage in the marketplace.

Stopfakes.gov is a one-stop shop for U.S. government tools and resources on intellectual property rights (IPR). You will find business guides, country toolkits, upcoming training events, and more on the site. See also export.gov.

How to Protect Your IP

IP includes copyrights, which cover works of authorship, such as books, logos, and software. It also includes patents, which protect inventions. Other types of IP include trademarks, designs, and trade secrets.

The first thing you need to do to safeguard your intellectual property is to file for protection in the United States. Your state’s bar association can recommend experienced lawyers who can help you with that.

Then you must be the first inventor to file for protection in the countries in which you currently do business or are certain to do business in the future. You should also consider filing for protection in countries that are well-known for counterfeit markets.

If you do business in nations that have free trade agreements with the U.S., IP protections are built into those agreements, but you’ll still need to file in each country to get those protections.

Conversely, if you do business in any country in the European Union, you only need to file for protection with the EU – not every individual nation.

If you have a registered IP right in the United States, these protections are territorial and do not extend to foreign countries. Additionally, most countries are a “first to file” country for trademark registration and “first inventor to file” for patent registration and therefore grant registration to the first filer regardless of first use in the market.

Utilizing professional consultants and IPR counsel is also an excellent resource and likely go-to solution.

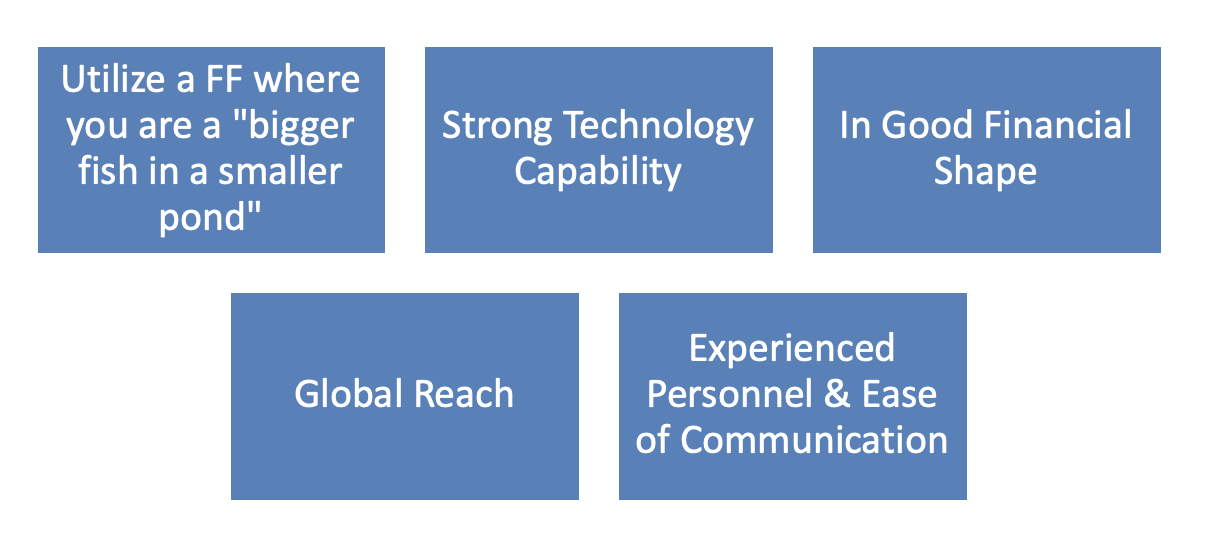

Utilize Quality Freight Forwarders

Finding quality freight forwarders is necessary to develop a strong export capability. Evaluation criteria:

Understand your “Landed Costs”

Understand your “Landed Costs”

Being competitive in export trade is important and knowing what all the costs are to get your goods from origin to destination will assist in that need.

Let us suppose the shipment of 100 units of a particular product arrives

- Supplier cost: $20 per unit

- Duty applicable at 4%

- Freight cost for the entire shipment was $200 – and the specific product represents one-quarter of the shipment (1/4th of the total shipment)

Total Landed Cost = $20 + (4% x 20) + ((200 x 25%)/100) = 20+ 0.8 + .5 = $21.3 per unit

Landed cost formula:

Net Landed Cost = Supplier Cost + (Duty charges) + (Shipment charges specific to this product/total units)

Landed costs will help determine margins and profits and create the competitive leverage that may be required in competitive export sales.

Make Sure The Shipment is Insured

The risk of loss and damage is great in export trade. Depending upon the INCO Term and how payments are made will determine who need s to insure the transaction.

Cargo insurance should be “All Risk”, “Warehouse to Warehouse” through a reputable broker and underwriter who specialize in international insurance exposures and risk management.

Make Sure You Get Paid

You need to be very diligent about getting paid. Having an unpaid export receivable can be very discouraging and problematic.

Options:

- Consignment

- Open Account (O/A)

- Collections

- Letter of Credit (L/C)

- Cash in Advance

Working with your bank and your customer will help determine the best option. Accommodating clients’ needs balanced with potential risks is a good concept.

Export Credit Insurance

Protect your export sales against nonpayment, offer open account credit terms to your buyers, and increase cash flow with EXIM’s export credit insurance.

There are also private insurance options such as with COFACE. We have specific contacts at COFACE we can refer you to.

The costs are low, the coverage is broad and is a great way to protect concern from foreign receivables.

Foreign Exchange Risk

Reduce the risk associated with the uncertainty of future exchange rates. A good way is to quote prices and require payment in U.S. dollars.

Payment Problems

Problems involving bad debts with your international buyer can set you back. Avoid potential payment issues and tap key resources to limit risk and resolve problems.

Summary

This information is to be utilized only as a reference guide and starting point in understanding all the requirements of exporting. Accessing additional resources and expertise will be central to developing a successful export business capability.

“The devil is in the detail” when it comes to establishing an export business, and the number of details can be intimidating. However, the housewares export market is thriving, the investment rewarded. IHA members and their products, even products that have been imported, have opportunities for sale in various export markets.

Blue Tiger International has a specific program designed for IHA members, which is discounted to provide assistance in export business development. For more information or to schedule a no-charge no-obligation initial consult, contact the author at tomcook@bluetigerintl.com.